Durante esta clase, volvimos a visitar la hoja de cálculo que preparamos la semana pasada y llegamos a nuestro porcentaje personal de nuestros ingresos que nos gastamos en necesidades, ahorros y deseos.

Luego, cada uno de los estudiantes compartió su hack financiero personal.

Ejemplo

Cada participante, desarrollo su hack personal con el uso de

https://spark.adobe.com. Creando un video o una postal comunicando su tip financiero.

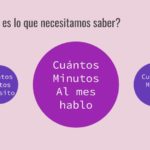

El tema principal del taller fue el crédito. Revisamos diferentes definiciones e iniciamos a comparar un escenarios en los que una persona da adelantos a sus deudas.

Utilizamos el siguiente gráfico para discutir los escenarios.

Hablamos sobre distintas calculadoras disponibles para ayudarnos a simular cómo podemos hacer pagos adicionales a nuestras tarjetas de crédito.

.

http://creditcards.com/calculators/minimum-payment.php

http://federalreserve.gov/creditcardcalculator/

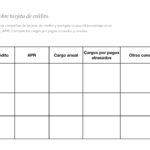

Recursos para comparar tarjetas de crédito:

:

Tarea:

- Terminar un segundo consejo/tip financiero personal, utilizando Adobe Spark o las diapositivas de Google

- Comparar 3 tarjetas de crédito diferentes usando la siguiente herramienta :

-

3. Escoja uno de los podcasts y esuche un episodio:

• Planet Money: https://itunes.apple.com/us/podcast/planet-money/id290783428?mt=2

•Freakonomics: https://itunes.apple.com/us/podcast/freakonomics-radio/id354668519?mt=2

• Tu dinero con Julia Sav: https://itunes.apple.com/us/podcast/tu-dinero-con-julie-stav

__________________________________________

During this class, we revisited the sheet we prepared last week and arrived at our personal percentage/balance of our income that is spent on needs, savings and wants.

Then each of the student shared their personal financial hack.

We continued to develop each personal hack with using

https://spark.adobe.com. Each of the student created a video or a postcard communicating a new hack.

Then we talked about credit. We went over different definitions and started comparing different scenarios in which one person will make advances to their debt and what that does to savings.

We used the following graphic to discuss the scenarios.

We talked about calculators available to help us understand how we can make extra payments to our credit cards.

http://creditcards.com/calculators/minimum-payment.php

http://federalreserve.gov/creditcardcalculator/

Resources to compare credit cards:

Homework:

- Finish a second personal financial tip, using Adobe Spark or google slides

- Compare 3 different credit cards using the following table:

3. Listen to one episode of one of the following podcasts.

• Planet Money: https://itunes.apple.com/us/podcast/planet-money/id290783428?mt=2

•Freakonomics: https://itunes.apple.com/us/podcast/freakonomics-radio/id354668519?mt=2

• Tu dinero con Julia Sav: https://itunes.apple.com/us/podcast/tu-dinero-con-julie-stav